Casino Industry Stocks

As we move into the new year, everyone is hoping for a respite from the novel coronavirus pandemic. With consumer discretionary incomes down in 2020, people decided to hunker down and spend money on essential items. Gambling stocks, understandably, took a hit.

However, as we ring in the new year, many analysts and investors are starting to see an uptick in gambling stocks as economies worldwide start to wake up from Covid-19 induced slumber. Plus, online betting is all the rage these days and is a secular tailwind for the sector.

You can be sure that publicly traded casino companies will try to take advantage of upcoming technology and/or new markets. That said, let’s look at 7 public casino companies that are eyeing major growth over the coming years. Las Vegas Sands Corp. Las Vegas Sands is the world’s largest casino company with over $14 billion in annual revenue. Gambling stocks are front and center for many investors these days, but not every company out there is a winner in this risky segment.More From InvestorPlace Why Everyone Is Investing in 5G All.

Gamblers are finding ready legal access to online gambling and sports betting services like DraftKings (NASDAQ:DKNG) and Penn National Gaming (NASDAQ:PENN). And with more states looking to legalize sports betting, they are certainly some positive headlines that are finally emanating from the space.

Popular Searches

However, it’s important to know that not every company is a winner in the sector. There is still a lot of uncertainty surrounding when and how traditional gambling venues will return. With the second wave of the pandemic upon us, there are still many questions regarding the long term vitality of pure gaming plays, especially those without a strong online presence.

Considering the rally in gambling stocks, you could be tempted to pick some of the larger players that are not doing well. However, this list will give you three names that you need to avoid in the space. Not every one of them is struggling with the same problems. But each one of them requires a lot of positive momentum before things get back on track.

- Las Vegas Sands (NYSE:LVS)

- Melco Resorts & Entertainment (NASDAQ:MLCO)

- Churchill Downs (NASDAQ:CHDN)

Gambling Stocks to Avoid: Las Vegas Sands (LVS)

© Provided by InvestorPlace a red sign with the Las Vegas Sands logoLVS had a strong 2019, but 2020 was disastrous for the resort developer and operator. The pandemic has created destruction for the tourism and gaming industries worldwide.

However, as the global economy begins to open back up, investors might be tempted to invest in LVS stock again.

But I would err on the side of caution. Shares are down 15.8% over the last 12 months, and the bleeding will not stop anytime soon. LVS’s primary markets remain Las Vegas and Macau, two geographies still under the pump.

The second wave is ruthless in the U.S.; the nation’s case numbers have more than doubled in less than two months. Even though Macau, Singapore, and Las Vegas are open for business, air travel remains depressed and consumer incomes are still not close to pre-pandemic levels.

In the current backdrop, Singapore is becoming an important piece of the overall revenue pie for LVS. The Marina Bay Sands location is now contributing more or less equally to Macau-based revenues.

However, we are not out of the woods yet. Singapore’s Ministry of Health has declared Marina Bay Sands as one of 16 new locations named on a list of places visited by positive Covid-19 cases. Plus, travel between mainland China, Hong Kong, Macau, and Singapore remains limited at this stage, which will affect its bottom line.

Before we wrap up here, let’s talk about the dividend suspension. Under normal circumstances, LVS usually offers a yield above 5%, quite attractive compared to peers.

However, these are difficult times, and cash flows need to be preserved. The company’s debt-equity ratio is 4.4x and interest coverage is – 0.9x. In this environment, debt servicing takes precedence over everything else. Regardless, the suspension of the dividend is another reason to not invest in the stock.

Melco Resorts (MLCO)

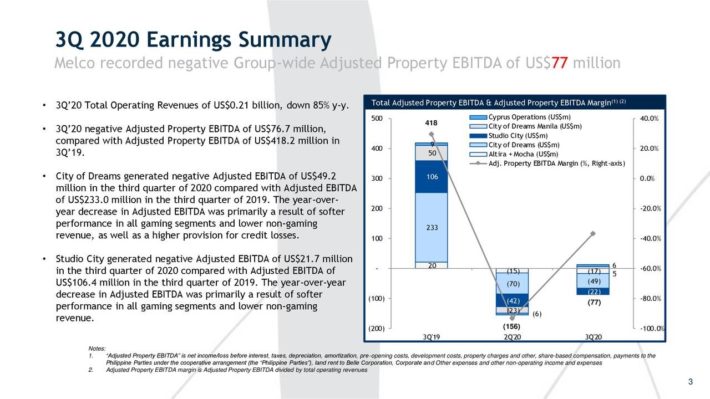

© Provided by InvestorPlace 10 Small-Cap Stocks to Buy Before They Grow Up Source: ShutterstockMLCO has underperformed the S&P 500 and the sector by 39.7% and 69.5% in the past year, respectively. The recent quarter served as a reminder that the company still has a long way to go.

Net loss attributable for the third quarter came in at $331.6 million on revenue of $214.06 million, compared with net income of $83.2 million on revenues of $1.4 billion in the third quarter of 2019. However, it is better than the net loss of $368.03 million recorded on revenues of $175.8 million.

As we move further along the path to recovery, these numbers should improve. The bad news is that MLCO will take longer than others to shake off the pandemic’s effects due to its high exposure to Macau casinos. Gambling revenue in the world’s biggest gaming market is down 70.5% in November year-on-year. November’s figure of 6.75 billion patacas compares unfavorably to analysts’ expectation of a drop of approximately 60% to 65%.

Melco Resorts is highly exposed to the ailing market; four of its five properties are in Macau. The next year should see a recovery in gaming activity within Macau. But that should happen late in the year, considering that it will take time to disseminate the vaccine and visa restrictions to lift.

In the short term, the company has the unenviable task of weathering what remains of the storm. Amidst this backdrop, the dividend suspension makes sense. It’s a sound strategy. When incomes are down, there is no use further encumbering the balance sheet with a growing dividend.

The dividend has fluctuated in recent years due to various reasons. But it’s generally an indicator of the financial health of the company. When things are going well, the company increases its dividend. And when the going gets tough, the casino operator either cuts or suspends the dividend.

Churchill Downs (CHDN)

© Provided by InvestorPlace Entrance to the Churchill Downs (CHDN) venue featuring a statue of the 2006 Kentucky Derby champion Barbaro. Source: Thomas Kelley / Shutterstock.comA few weeks back, CHDN stock broke into a new 52-week high, hitting a peak of $206.03 per share, before settling a bit. Regardless, CHDN has outperformed the S&P 500 by 36.5% in the past year. That seems strange since the company is still a largely brick-and-mortar casino player, with 10 casinos in eight states.

Institutional investors are betting that being the sole owner of the Kentucky Derby and TwinSpires will pay dividends. The Kentucky Derby was the most-watched sports event in the U.S. since the Super Bowl, with 8.4 million viewers across NBC and NBC Sports Digital in September 2020.

TwinSpires is the largest online horse racing gaming platform in the country. CHDN’s BetAmerica is also an important player in the online betting space, but the brand is in a nascent state.

But one has to give credit where it’s due. In the long run, these platforms will contribute to the company’s success. However, in the interim, the company will continue to bleed cash. With BetAmerica new to the game, and more established names like DraftKings and Barstool well entrenched in the market, there is still a lot to play for.

Institutional investors don’t seem to mind this, though. In aggregate, they control 74.26% of the outstanding share capital of the company.

Hedge funds don’t think like retail investors and can afford to play the long game. For them, consistent dividend growth and swings in per-share values do not matter as much.

Casino Industry Stocks Quote

A dividend yield of 0.3% and a 12-month price target of $199 per share doesn’t strike me as impressive enough to warrant a retail investor’s interest. Maybe a couple of years down the line, CHDN will become more attractive when some of its expected growth materializes.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Casino Industry Stocks History

Casino Stocks Usa

Casino Stocks Today

| Date | Stock | Signal | Type |

|---|---|---|---|

| 2021-03-09 | ACEL | Pocket Pivot | Bullish Swing Setup |

| 2021-03-09 | ACEL | Upper Bollinger Band Walk | Strength |

| 2021-03-09 | AGS | Fell Below 20 DMA | Bearish |

| 2021-03-09 | AGS | Non-ADX 1,2,3,4 Bullish | Bullish Swing Setup |

| 2021-03-09 | AGS | New Downtrend | Bearish |

| 2021-03-09 | CHDN | 180 Bullish Setup | Bullish Swing Setup |

| 2021-03-09 | CPHC | Boomer Buy Setup | Bullish Swing Setup |

| 2021-03-09 | CPHC | Narrow Range Bar | Range Contraction |

| 2021-03-09 | CPHC | Upper Bollinger Band Walk | Strength |

| 2021-03-09 | CPHC | Non-ADX 1,2,3,4 Bullish | Bullish Swing Setup |

| 2021-03-09 | CPHC | 1,2,3 Pullback Bullish | Bullish Swing Setup |

| 2021-03-09 | ELYS | MACD Bearish Centerline Cross | Bearish |

| 2021-03-09 | ELYS | New Uptrend | Bullish |

| 2021-03-09 | ELYS | NR7 | Range Contraction |

| 2021-03-09 | GAN | MACD Bearish Centerline Cross | Bearish |

| 2021-03-09 | GAN | 50 DMA Support | Bullish |

| 2021-03-09 | GDEN | NR7-2 | Range Contraction |

| 2021-03-09 | GDEN | MACD Bearish Signal Line Cross | Bearish |

| 2021-03-09 | GDEN | NR7 | Range Contraction |

| 2021-03-09 | GMBL | 20 DMA Resistance | Bearish |

| 2021-03-09 | GMBL | Stochastic Reached Oversold | Weakness |

| 2021-03-09 | IGT | Lower Bollinger Band Walk | Weakness |

| 2021-03-09 | IGT | MACD Bearish Centerline Cross | Bearish |

| 2021-03-09 | SGMS | NR7 | Range Contraction |

| 2021-03-09 | SGMS | 20 DMA Resistance | Bearish |

| 2021-03-09 | WBAI | NR7-2 | Range Contraction |

| 2021-03-09 | WBAI | NR7 | Range Contraction |

| 2021-03-09 | WBAI | 20 DMA Resistance | Bearish |

| 2021-03-09 | WBAI | Stochastic Buy Signal | Bullish |